Getting My Lamina Loans To Work

Table of ContentsLamina Loans for DummiesAn Unbiased View of Lamina LoansFascination About Lamina LoansLamina Loans Things To Know Before You BuySee This Report on Lamina LoansThe Of Lamina Loans

Lenders count completely on your credit reliability, revenue level and quantity of existing debts when choosing whether you're a good prospect. Since the risk is greater for the lender, APRs are additionally generally higher on unsecured fundings (Lamina Loans).

In specific instances, the name or the objective of the loan matters. The purpose of your lending can determine your rates and even creditworthiness in the eyes of lenders. For example, some lenders will provide different individual loan terms based upon the financing's desired objective or just use individual finances for certain functions.

Not known Facts About Lamina Loans

If you are accepted, the loan provider additionally designates a rates of interest to your financing. The interest rate (APR) establishes the amount of passion you'll pay on your loan. Like rates of interest, APRs are shared as a percentage. APRs likewise take costs into account to provide you a better sense of your financing's total expense.

Calculate your estimated finance costs by using this personal funding calculator. Input price quotes of the car loan quantity, passion price and also lending term to get an idea of your potential repayment and also total costs for taking out a personal finance. Your three-digit credit report plays a huge duty in your capacity to obtain money and score a favorable rates of interest.

, compare your loan terms as well as each lending institution's charges typically, both interest rate and fees will certainly be shown in the APR. Once you have actually discovered a loan provider you 'd such as to function with, it's time to move onward.

The Main Principles Of Lamina Loans

Getting a funding isn't as tough as it used to be, however you can't simply use for a car loan anywhere. Your debt score matters, as well as a firm that lines up with your scenario is best.

Below's everything you need to learn about searching for and also getting lendings online. You can get lots of loan types online, but one of the most usual (and frequently most versatile) choice is the on the internet individual finance. Many individual finances are unsafe, suggesting you do not require security, and also you can use them for almost any purpose.

The 5-Minute Rule for Lamina Loans

: Fair, negative Yes: As quick as 1 business day: 0% 8%: $15 or 5% of repayment: 36 or 60 months For extra options, look into our choices for the finest individual finance lenders. Quick, hassle-free lending applications Same-day financing commonly available Flexible as well as can be used for financial obligation consolidation, service expenses, residence improvements, as well as more Lower prices than online payday advance loan Unprotected, so no security is at danger Easy to contrast options as well as prices Bad-credit options offered Rates may be greater than a safeguarded car loan, such as a residence equity lending Rates may be greater than with your individual financial institution or cooperative credit union Require due diligence (cash advance fundings and also predatory loan providers may impersonate individual loan lenders) The financings we have actually pointed out are online individual fundings, yet you need to watch out for cash advance.

Online financings make window shopping basic and practical. However what should you consider when comparing your alternatives as well as quotes from different lending institutions? Let's look at a couple of components. The APRor yearly percentage rateindicates the total loaning expenses throughout the year, consisting of the passion rate and also costs. AS AN EXAMPLE, an APR of 5% on a $30,000 finance would indicate you 'd pay concerning $1,500 in passion annually to obtain the money.

You can discover more in our overview to APRs vs. rate of interest. Every lender charges different charges, such as source costs, late settlement fees, application costs, and extra. If you're comparing APRs, most of these charges should be represented. Various other fees are not consisted of in the APR, such as late payment charges or early repayment penalties.

Lamina Loans - Questions

Be certain to obtain a full failure of any charges you'll pay with each loan provider, so see this page you can consider them in your choice. Contrast the total regards to each finance alternative. Longer settlement terms mean reduced monthly payments, but they also indicate paying extra in passion in the lengthy run.

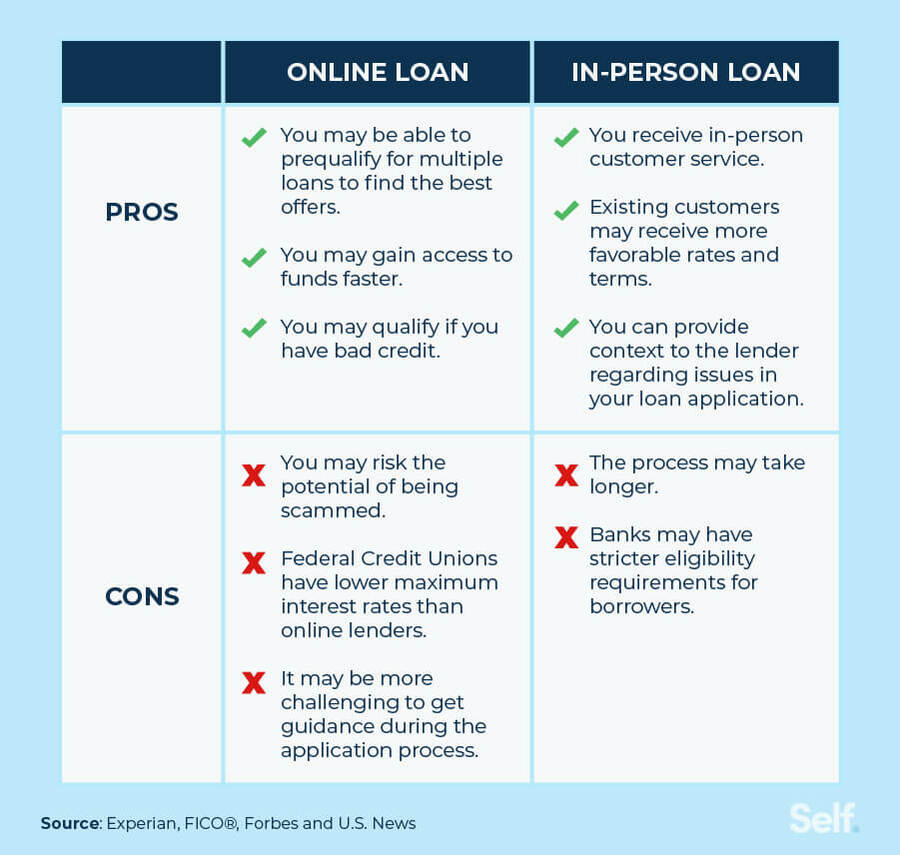

On-line car loans can offer you with the money you need to cover expenses promptly and also comfortably. Prior to read more you move forward with an online lending, however, ensure that the financing is secure and also the loan provider is legit. Below are several of the advantages and disadvantages of online loans. Safe on-line financings use a range of advantages including: You can get an online financing any time from the comfort of your own residence.

When you are investigating numerous on the internet lendings, you'll find it very easy to compare the deals you receive. You'll be able to establish which finance is the most effective option for your specific budget plan, requires, and preferences. Upon authorization, most loan providers that provide secure quick finances online will distribute the cash to your savings account within 24-hour.

10 Easy Facts About Lamina Loans Shown

Online car loan lenders usually use pre-approvals. Even if you have bad or reasonable credit important site report, you might still obtain authorized for quick risk-free lendings online.